ny paid family leave tax withholding

The program is effective on January 1. If an employer collects payroll deductions.

The Complete Guide To New York Payroll Payroll Taxes 2022

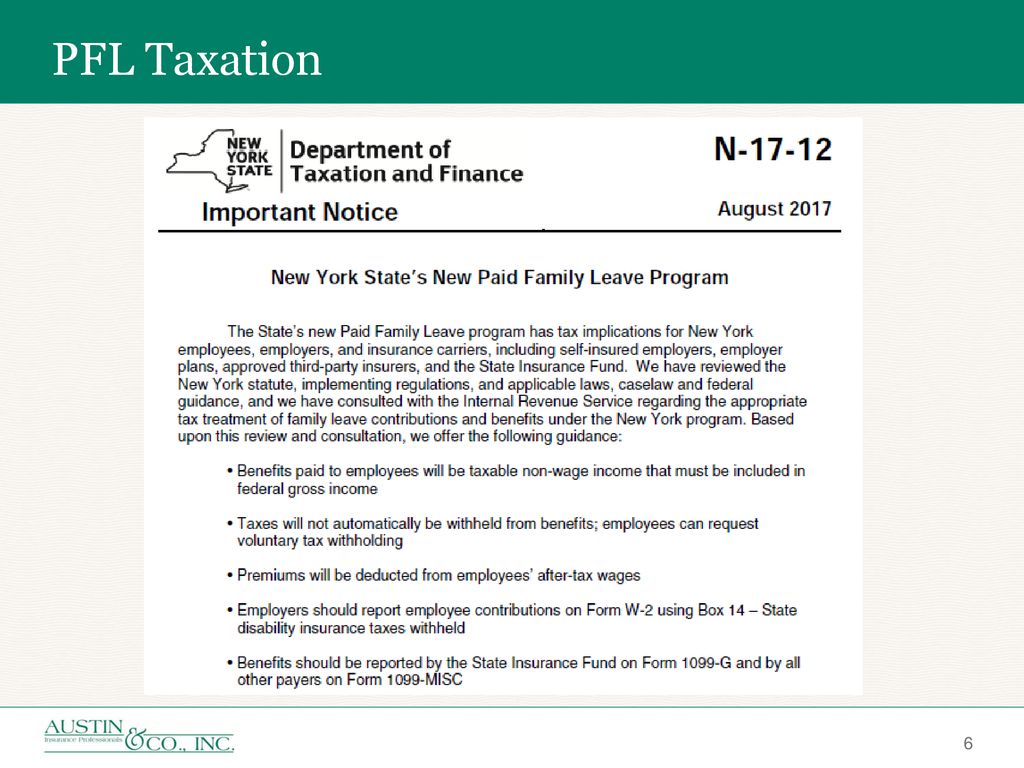

At this time it appears that employees can choose to withhold a flat 10 percent of their benefit for federal taxes and a flat 25 percent of their benefit for state taxes.

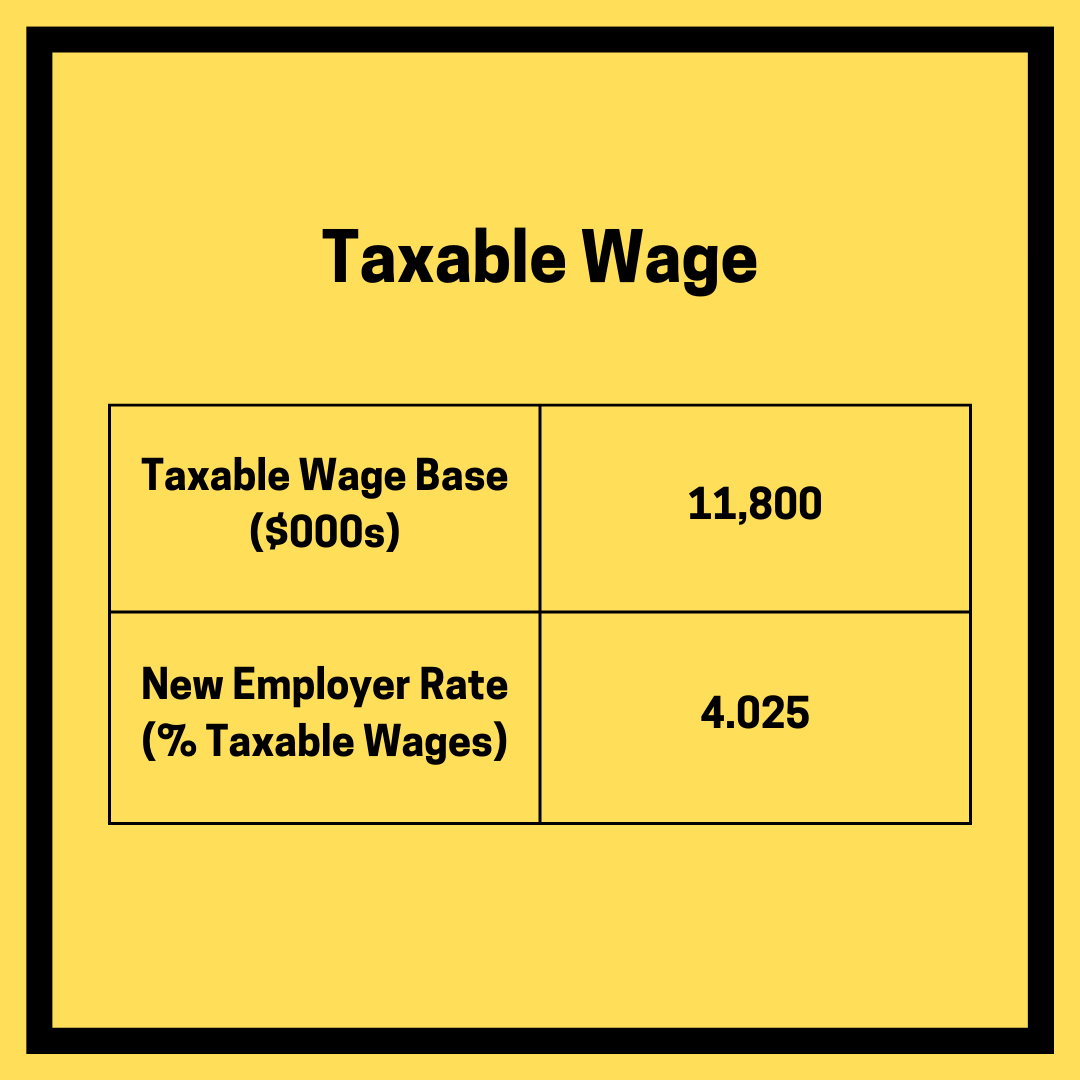

. No deductions for PFL are taken from a businesses tax contributions. The weekly contribution rate for New York Paid Family Leave is 0511 of the employees weekly wage capped at New. Each employees total remuneration is the amount prior to any deductions including deductions for the premiums for New Yorks Paid Family Leave program.

If your average weekly wage is less than 100 you will receive your full wages during a period of PFL. Enhanced Disability and Paid Family Leave Benefits. Federal and New York income tax will not automatically be withheld from PFL benefits.

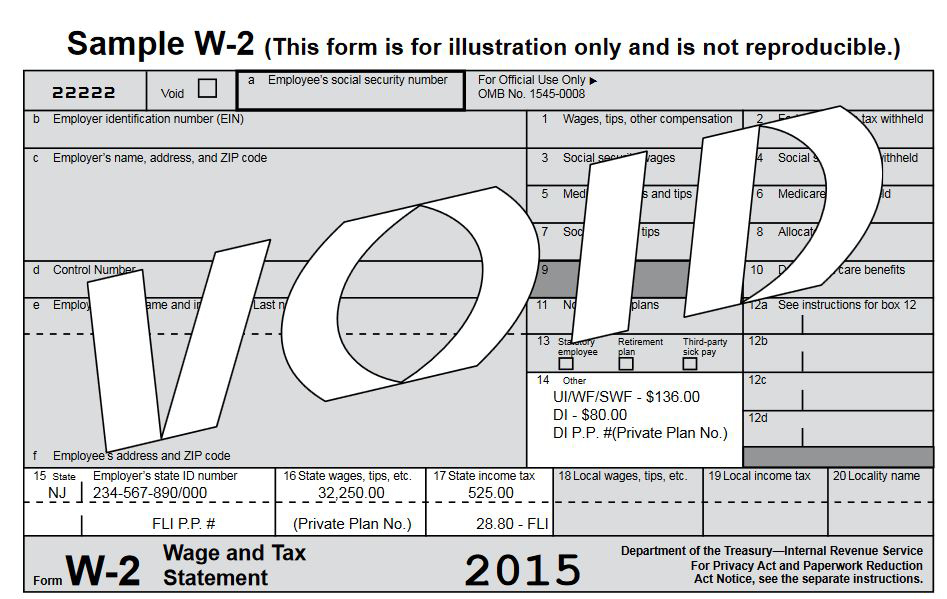

The contribution remains at just over half of one percent of an employees gross. State disability needs to be reported separately from the Paid Family Leave in box 14 of Form. Employers are required to withhold and pay personal income taxes on wages salaries bonuses commissions and other similar income paid to employees.

The weekly contribution rate for New York Paid Family Leave is 0511 of the employees weekly wage capped at New York States current average weekly wage of 145017. If an employee leaves after PFL contributions have been withheld but before Jan. Employees can request voluntary withholding of.

Income tax withholding from PFL benefits. New York State Paid Family Leave is insurance that may be funded by employees through payroll deductions. The paid family leave can be called Family Leave SDI as long as it is a separate item in box 14.

1 Obtain Paid Family Leave coverage. In November 2021 Governor Kathy Hochul signed legislation to further strengthen Paid Family Leave by expanding family care to cover siblings effective January 1 2023. New York designed Paid Family Leave to be easy for employers to implement with three key tasks.

New York Paid Family Leave is insurance that is funded by employees through payroll deductions. Withholding Tax Information Center. 518-485-6654 Paid family leave In 2016 Governor Cuomo signed the nations strongest and most comprehensive Paid Family Leave policy into law.

Increased monetary pay out a shorter waiting period duration to. 2022 Paid Family Leave Payroll Deduction Calculator If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0511 of your gross wages. 1 2018 the employer is not required to refund the contributions.

Each year the Department of Financial Services sets the employee contribution rate to match. The New York Paid Family Leave Program was discussed in earlier posts on August 31 2017 August 17 2017 and June 29 2017. For example if your average weekly wage is 125 your PFL benefit rate would be 100.

2 Collect employee contributions to pay for their. In 2021 employees taking Paid Family Leave will receive 67 of their average weekly wage up to a cap of 67 of the current Statewide Average Weekly Wage of 145017. An employer may choose to provide enhanced benefits such as.

2021 Paid Family Leave Rate Increase. 2021 Paid Family Leave Rate.

New York Paid Family Leave Shelterpoint

New York Paid Family Leave An Employer Guide Ask Gusto

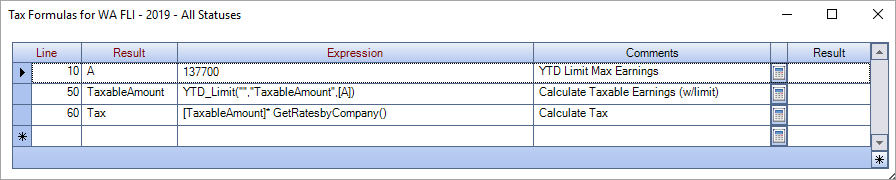

Setting Up Washington Paid Family And Medical Leave

/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

What Does All These Mean On My Pay Statement R Tax

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Is Paid Family Leave Taxable Employee Contributions Benefits

Time Off To Care State Actions On Paid Family Leave

Nj Division Of Taxation Common Filing Mistakes

The Next Big Question On New York Paid Family Leave How Do We Determine Tax Obligations

Ma Pfml Claims Faq Usable Life

2021 Instructions For Schedule H 2021 Internal Revenue Service

New York Paid Family Leave Resource Guide

Paid Family Leave Employee Contributions Payroll And Withholding The Standard

Tax Implications Of New York Paid Family Leave Gtm Business

Taxation Guidance Is Finally Here For Ny Paid Family Leave The Standard

Paid Family Leave Expands In New York The Cpa Journal