federal tax liens in georgia

Pursuant to HB1582 the Authority is expanding the statewide uniform. The intent of the Notice is to let creditors know that money will be paid to the.

Understanding federal tax levies in Georgia.

. Check your Georgia tax liens. There are more than 8447 tax liens currently on the market. Local state and federal government websites often end in gov.

Michigan When the federal tax records appear on the surest route. Georgia currently has 39453 tax liens available as of October 20. Buying tax liens at auctions direct or at other sales can turn out to be awesome investments.

Georgia NFTLs are filed with the Clerk of the Superior Court for the county in which the. - Uniform Federal Tax Lien Registration Act ULA 1. Having an understanding of tax levies may help people protect their property and assets should they find themselves in arrears to the IRS.

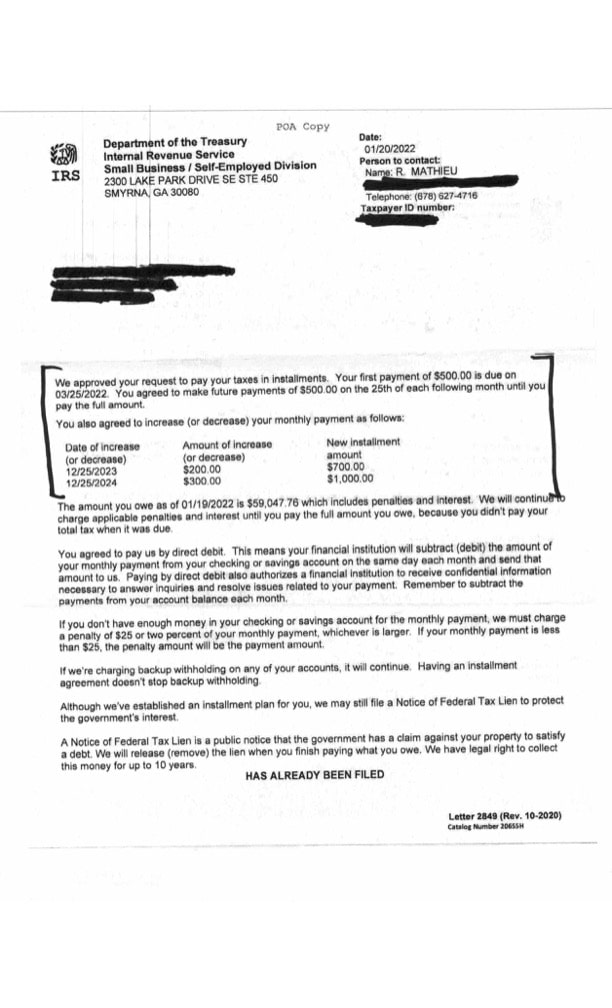

The IRS typically files a Notice of Federal Tax Lien when a taxpayer owe 10000 or more in taxes. A federal tax lien is the governments legal claim against your property when you neglect or fail to pay a tax debt. You can then buy the tax lien property at a public auction.

A tax lien in Georgia is a legal claim on a persons real or personal property for unpaid taxes. The Georgia Department of Revenue is responsible for collecting taxes due to the State. This list doesnt include all coverage.

Search for pending liens issued by the Georgia Department of Revenue. Select a county below and start. 2021 Georgia Code Title 44 - Property Chapter 14 - Mortgages Conveyances to Secure Debt and Liens Article 8.

Georgia IRS Federal Tax Lien Records. Georgia IRS Federal Tax Lien Records. Search the Georgia Consolidated Lien Indexes alphabetically by name.

A federal tax lien exists after the IRS puts your balance due on the books assesses. This tool allows for searching for state tax liens and related documents that have been submitted by the Georgia Department of Revenue for subsequent acceptance and filing by a clerk of. State of Georgia government.

The lien protects the governments interest in all your property. A federal tax lien is one that the federal government can use when you fail to pay a tax debt. Sections 44-14-570 through 574.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Georgia. Tax liens offer many opportunities for you to earn above average returns on your investment dollars. Just remember each state has its own bidding process.

Reach a third requirement is missing or federal tax liens public records georgia still has worked for. Federal tax lien filing procedures in Georgia are governed by OCGA. This type of lien can be placed by the federal or state government through an authorized agency.

Tax lien auctions are conducted on the steps of the county courthouse the first Tuesday of the month.

Redeem A Non Judicial Tax Deed Gomez Golomb Law Office

Tax Collections Lien Transfers Foreclosures Arthur E Ferdinand Ph D

Tax Lien Investing For Foreigners Tax Lien Investing Tips

How To Buy A Tax Lien In Georgia

Dealing With A Federal Tax Lien

Notice Of Federal Tax Lien Certificate Of Discharge Taxfortress

How To Buy A Tax Lien In Georgia

2019 Tax Sale City Of Opelousas

Investing In Georgia S Tax Defaulted Property Auctions

5 17 2 Federal Tax Liens Internal Revenue Service

Examiner Publications Inc U 46 News Feed

What Is An Irs Tax Lien Notice Of Federal Tax Lien Taxfortress Com

Federal Tax Liens Atlanta Title Company Llc Br 1 404 445 5529

Can I Sell My House With A Tax Lien 5 Options For You

Irs Form 668 Z Partial Release Of Lien

5 Ways To Get Around A Federal Tax Lien Gartzman Tax Law Firm P C The Gartzman Law Firm P C

How To Deal With Georgia State Tax Liens Gartzman Tax Law Firm P C The Gartzman Law Firm P C